End-of-year giving is an effective way to give back to our community while maximizing tax benefits. Whether you replenish your current donor-advised fund or open a new fund, the Atlanta Jewish Foundation makes year-end charitable planning a smooth and flexible process.

Please follow the steps below to ensure the accurate and timely processing of contributions and grants in 2025.

1. Review the Deadlines

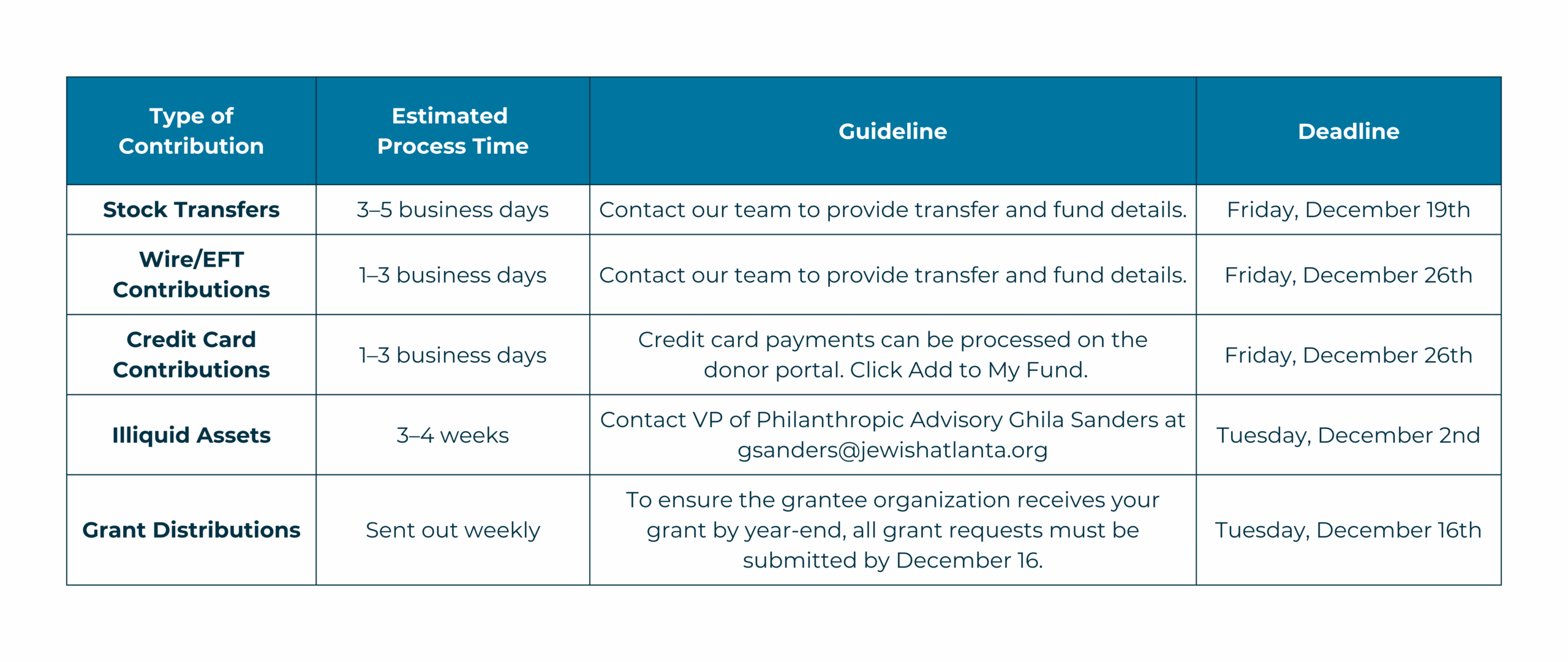

See the table below for specific 2025 charitable contributions deadlines. Even if you’re unsure which organizations you’d like to support, contributing to your fund before the end of the year can help you maximize tax benefits.

2. Contribute to Your Fund

There are several ways to contribute to your Atlanta Jewish Foundation fund:

- Online Donor Portal. Log in to your Donor Portal and easily add to your fund with credit card or online check. Go to “Add to My Fund” or “Funding Instructions” to contribute to your DAF.

- Funding with Cash. Add to your fund by mailing a check.

Make check payable to: Jewish Federation of Greater Atlanta Inc.

Mailing Address:

The Atlanta Jewish Foundation

PO Box 117860

Atlanta, Georgia 30368-7860

- EFT (Electronic Fund Transfer) & Wire. Before initiating a transfer, please call Donor Services at 404-575-3767 or email us with your name, expected amount, and intention for the funds.

- Funding with Stock. Before initiating a transfer, please call Donor Services at 404-575-3767 or email us with your name, the symbols, number of shares, and destination of where funds should be distributed.

- Illiquid or Complex Assets. please email us for more information.

3. Update Our Team

To ensure accurate and speedy processing of your funds, please contact the Atlanta Jewish Foundation team at donorservices@jewishatlanta.org or call 404-575-3767 to provide your fund and contribution details. We look forward to assisting you!

Please remember, if you are sending stock to the Atlanta Jewish Foundation, please submit the name of the fund receiving the contribution and a description of the contribution (e.g., 125 shares of Apple stock or a $125,000 wire transfer initiated on X date)

5 Easy Ways to Give

- Appreciated Assets (Publicly Traded Stocks, Real Estate, or Other Investments): Use appreciated stocks (held for more than one year) to make a charitable gift. You will save taxes by not having to pay any capital gains tax, and you will receive a deduction for the full fair market value of the stock donated. A double win! If you’re selling a business, real estate interest or other highly appreciated assets, think about where philanthropy fits in – not only as an act of generosity, but as a tax-saving strategy. Making your gift in advance of the sale may help you avoid capital gains taxes and get a larger tax deduction.

- Donor-Advised Funds (DAF): Year-end is an excellent time to replenish your donor-advised fund or establish a new fund for your family. A DAF allows you to maximize tax benefits while maintaining flexibility in your giving.

One powerful strategy is “bunching” – making multiple years of charitable contributions in a single tax year to exceed the standard deduction threshold and secure a larger itemized deduction. For example, instead of giving annually in both 2025 and 2026, you could contribute the combined amount in 2025 to your DAF at the Atlanta Jewish Foundation. You’ll receive the full deduction in 2025, then take the standard deduction in 2026, while still distributing grants to your favorite charities on your own timetable.

This approach can save philanthropists – especially those giving in the $5,000 to $25,000 range – thousands of dollars in taxes without reducing their charitable impact. Donors can also “front-load” several years of giving into their DAF, continuing to support causes they care about consistently, while benefiting from significant tax advantages. - IRA’s: If you are age 70 ½ or older, you can make an IRA qualified charitable distribution (QCD), or a direct tax-free transfer of funds, from your IRA payable directly to a qualified charity. This option is still available in 2025, and is a fantastic use of your otherwise taxable IRA dollars. While IRA’s are a great way to contribute to the Jewish Federation’s Annual Campaign and to create an endowment or restricted fund, they cannot be used to contribute to a Donor-Advised Fund.

- Cash Gifts: You can deduct up to 60% of your adjusted gross income for your cash gift. Let the Atlanta Jewish Foundation walk you through it.

- Estate Plan Review: With current, and potential, tax law changes, many people are looking at their estate plans to take maximum advantage of the current tax laws. This is an ideal time to incorporate philanthropy into your plan. We’re here to help you, and we can work directly with your advisor.